VILLAGE OF WALBRIDGE

TAX INFORMATION PAGE

Village of Walbridge Tax Rate 1.5%

1.0 % Credit for Taxes paid outside the Village.

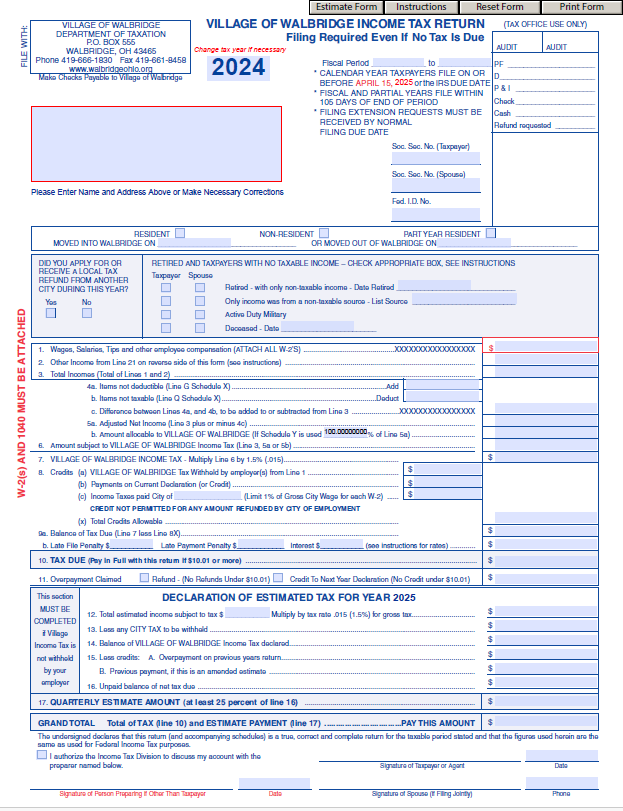

2025 TAX FILING

DUE DATE

APRIL 15, 2026

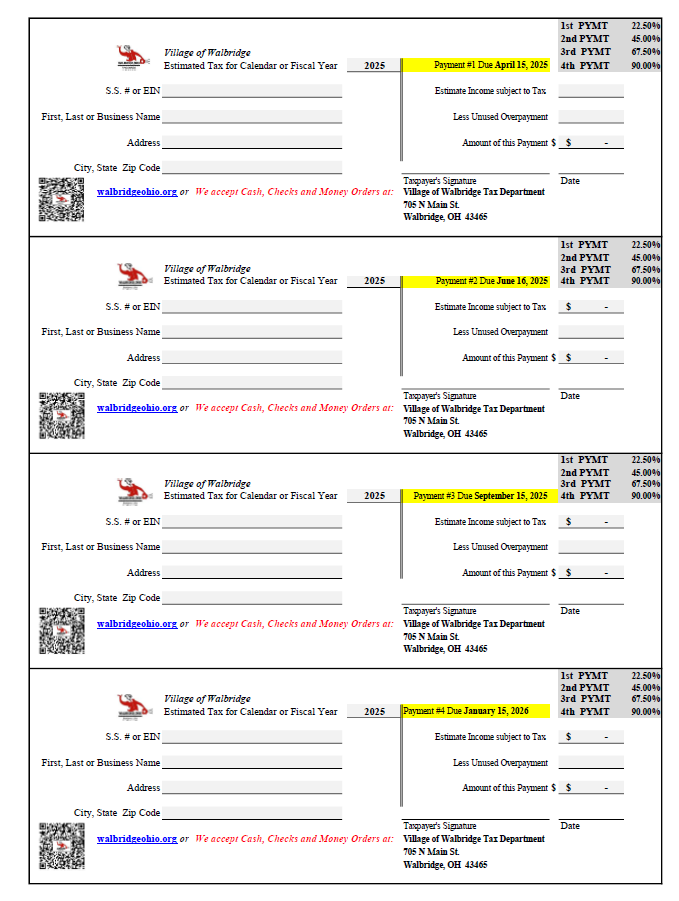

2025 Estimated Tax Payment due date(s):

1st QRT - April 15, 2025

2nd QRT - June 16, 2025

3rd QRT - Sept. 15, 2025

4th QRT - Jan. 15, 2026

ONLINE PAYMENT

Payments can be made by clicking on the link or the QR Code to make it easy. We also accept Cash, Checks, or Money Orders which can be mailed or dropped off at our Admin Building.

NOTICE:

The interest rate is the Federal short-term rate, rounded to the nearest whole number percent, plus five percent. The rate shall apply for the calendar year following July of the year in which the Federal short-term rate is determined.

Annual Interest Rate

The 2026 interest rate is nine percent (9%) per year or .75 percent per month.

The 2025 interest rate is ten percent (10%) per year or .833 percent per month.

The 2024 interest rate is ten percent (10%) per year or .833 percent per month.

The 2023 interest rate is seven percent (7%) per year or .583 percent per month.

The 2022 interest rate is five percent (5%) per year or .417 percent per month.

The 2021 interest rate is five percent (5%) per year or .417 percent per month.

The 2020 interest rate is seven percent (7%) per year or .583 percent per month.

The 2019 interest rate is seven percent (7%) per year or .583 percent per month.

The 2018 interest rate is six percent (6%) per year or .5 percent per month.

The 2017 interest rate is six percent (6%) per year or .5 percent per month.

The 2016 interest rate is five percent (5%) per year or .417 percent per month.

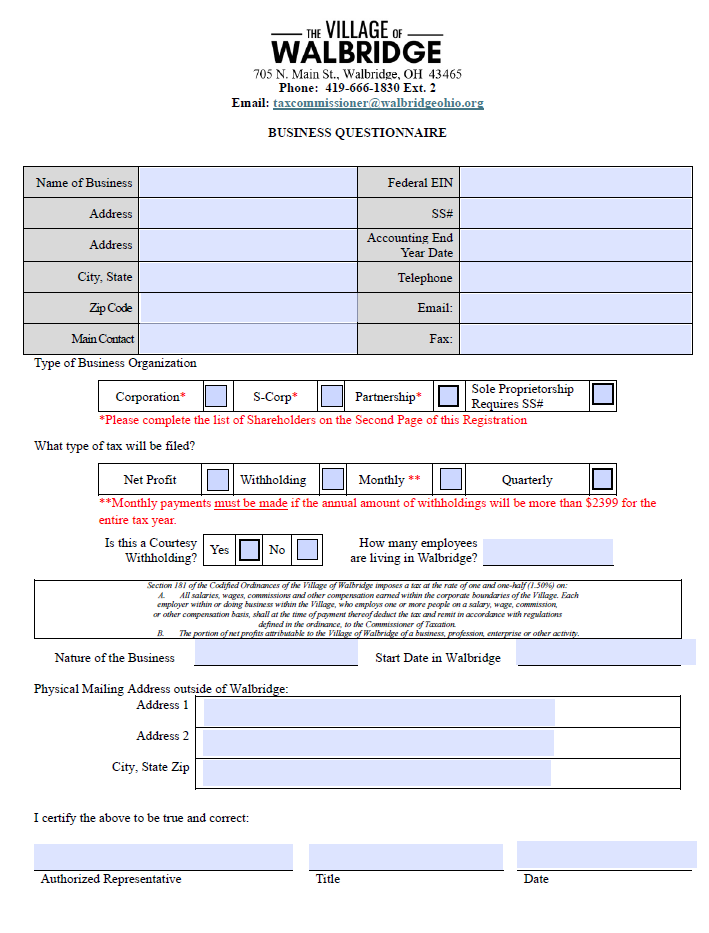

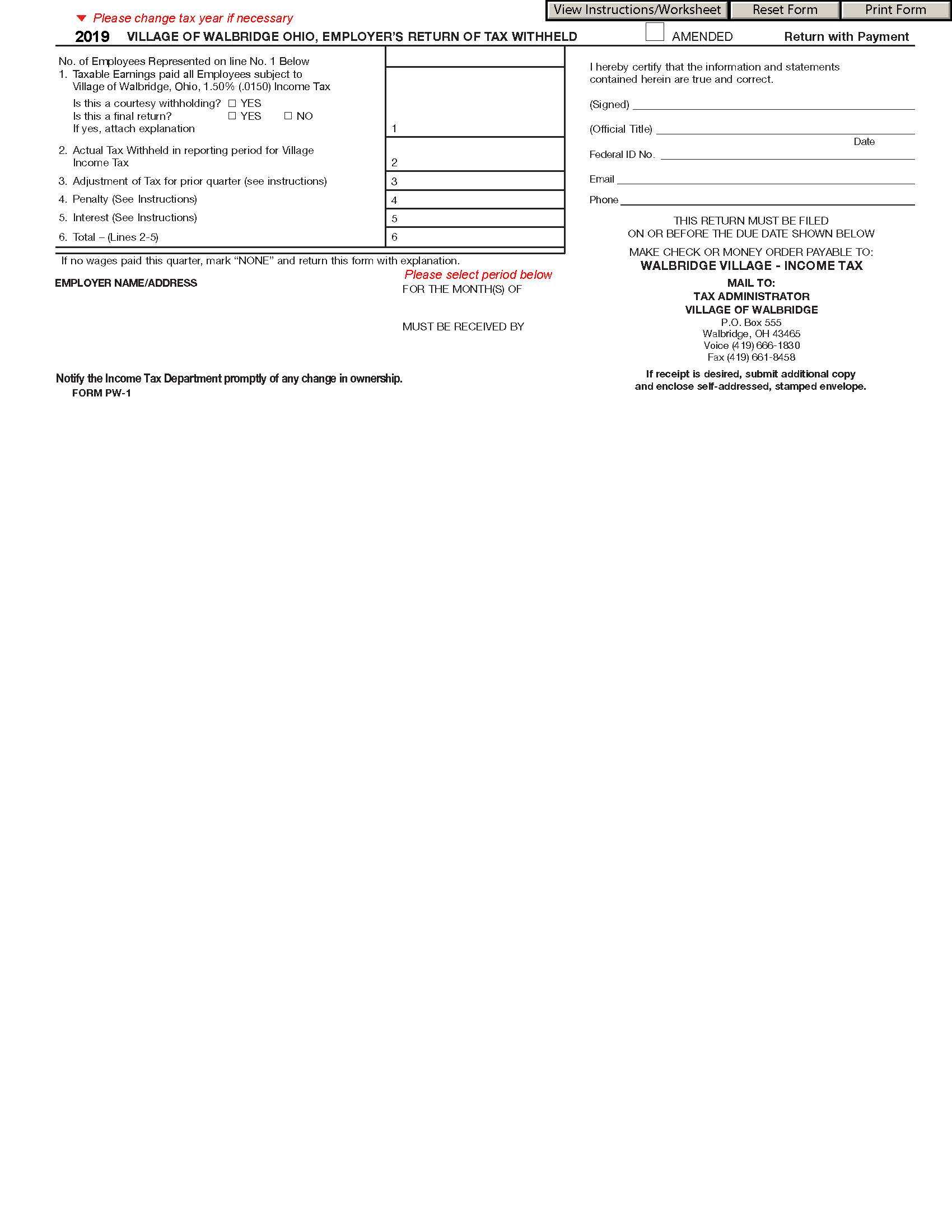

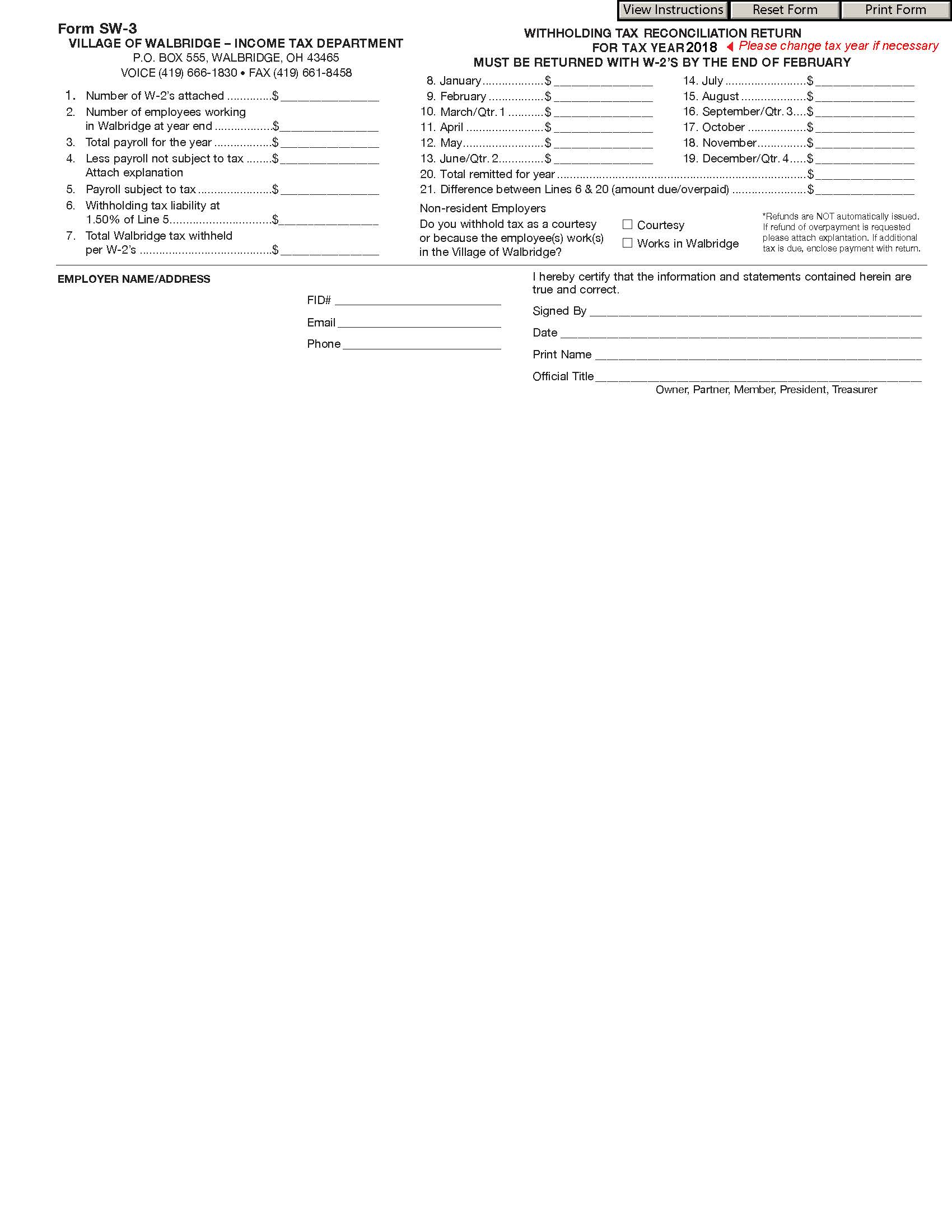

Employer Withholding Forms

Tax Year 2024/2025 Tax Forms

*THIS FORM NEEDS TO BE DOWNLOADED TO DESKTOP

(phones do NOT hold information) If the YEAR is not showing 2024 - please correct in form

SUBMIT YOUR DOCUMENTS

You can file your documents via this SHAREFILE Link. PLEASE SUBMIT IT AS A PDF DOCUMENT.

- Village of Walbridge Return

- W-2(s)

- Federal 1040 (1st Page) or Federal 1040-SR (1st & 2nd Pages)

- Schedule 1

- Schedule C, E, or F

- Schedule K-1 (1065 or S-Corp)